For U.S. businesses engaging in international logistics, understanding duty drawback — or partnering with someone who does — is a pivotal process. Duty drawback, which is a refund of 99% of the duties paid on goods imported to the U.S. that get exported afterward, can be complicated and intimidating, but having a solid understanding of it is essential for importers and exporters.

A business that can file clean drawback claims and execute flawless drawback audits will protect its profits and spend less time on fixing errors.

This post will cover some tips for maximizing duty drawback refunds.

Understanding How Duty Drawback Works

Before we get to the keys of optimizing duty drawback, let’s take a quick step-by-step overview of how the duty drawback process works:

The goods are imported: A company imports the goods and pays the necessary duties and taxes.

The goods are exported: The company then exports them in their original state or as part of a manufactured product.

A claim is filed: A duty drawback claim can be made to U.S. Customs and Border Protection by an importer, manufacturer, exporter, or their representation. There are several types of duty drawbacks, so clearly understanding how the current shipment is categorized is essential.

Review: The CPB then verifies the documents and approves or denies the claim.

Refund: If approved, a refund is released.

Possibility of an audit: Records must be kept in case the CPB implements an audit.

That’s a bare-bones rundown of the duty drawback process. The implications for import and export businesses to fully understand the process and have a plan to execute claims is pivotal because their bottom line depends on it.

The Role Of Duty Drawback In Maximizing Refunds

Being meticulous during the duty drawback process directly reduces the cost of importing products by receiving the maximum amount of refunds available. When done correctly and efficiently, duty drawback can inject cash flow into a business, allowing it to sell its goods on the international market competitively. This can help boost economic growth and benefit emerging companies looking to widen their market share.

The effect of the duty drawback process is significant. On the front end, it encourages transparency and fairness so that companies exist on an even playing field. Refunds help stimulate global trade, which likely leads to investment and innovation.

Five Professional Tips For Optimizing Your Duty Drawback

Now that we have covered the process’s basics — let’s dive into some advice. Here are five tips for optimizing duty drawback.

1. Thorough Documentation And Record-Keeping

Like almost any other type of refund, careful documentation and record-keeping is a must. A dedicated, careful tracking system is necessary to maximize refunds and pass audits.

Messy record keeping is not only going to lead to a time-consuming nightmare when it’s time to file a claim, but it could lose a company a lot of money via missing information that leads to a denial. By law, a company needs to keep all import and export documentation for five years, including the commercial invoice, the bill of lading, and the export declaration. All manufacturing and financial records should also be kept.

2. Understanding The Different Types of Duty Drawback

There are several types of duty drawback, but there are three primary types: manufacturing drawback, unused merchandise drawback, and rejected merchandise drawback. It’s important to have an in-depth understanding of each one and correctly classify the products you are dealing with.

It’s also necessary to understand the intricacies of your supply chain. Not only where the imports are coming from and where the exports are going, but all of the important steps, manufacturing, and documentation that is part of the process.

3. Coordinating With A Duty Drawback Expert

Sometimes, having an in-house expert or team that can deal with duty drawback is not in the cards, but partnering with a drawback expert is a great option. J.M. Rodgers Co., Inc. is a third-generation, family-owned corporation that has led duty drawback services for more than 70 years.

JMR has one of the largest dedicated drawback divisions in the United States and has become the largest filer of drawback by volume in the country. It’s important to find a company that has a wealth of experience because they can simplify a sometimes complicated process.

4. Staying Updated With Changing Laws And Regulations

In a quickly-changing industry, it’s important to keep up with the latest laws and regulations. For instance, The Trade Facilitation and Trade Enforcement Act of 2015, which went into effect in 2019, changed the drawback claims filing process, and it also altered the timeframe for record-keeping responsibilities. It also expanded eligibility for the drawback program. And that’s only a small part of what the act changed. New laws need to be closely paid attention to.

5. Investing In Automation For Accurate Tracking And Claiming

Technology is a critical piece of the puzzle for maximizing refunds and reducing time spent. J.M. Rodgers has its own in-house proprietary customs-approved software, with an IT team of eight data experts who utilize automation to deliver the industry’s best-duty drawback results. Automation drives accurate and speedy paperwork.

Leveraging Duty Drawback For Business Growth

Maximizing duty drawback has significant financial benefits. Companies that receive full duty drawback are then often able to offer their goods at a competitive price and reinvest the money from duty drawback into their business, growing at a quicker rate. As a business, you don’t want to leave money on the table for no good reason, but it happens all of the time. Properly leveraging duty drawback is a tactic that smart businesses use to get ahead.

If your current supply chain allows for the opportunity for drawback, then you should be taking steps to receive the refund, because you are entitled to it. It’s your money.

Start Optimizing Your Duty Drawback

To sum everything up succinctly, a more efficient duty drawback filing process and records-keeping plan means more money for your business. And in the international shipping industry, there are numerous responsibilities and opportunities that the extra cash flow will help with. It’s important to have a plan to tackle duty drawback responsibilities in-house or pair with an experienced customs broker who can handle it for you.

J.M. Rodgers is a leader in the duty drawback industry. JMR has extensive experience filing claims and handling audits and leverages an unparalleled customer service model built on communication. Through its hands-on approach to customer service, J.M. Rodgers provides every account with a dedicated account team. JMR’s 12 senior drawback account specialists have more than 208 years of experience combined.

Want to learn more about starting a duty drawback partnership with J.M. Rodgers?

Contact our team today, and one of our experts will analyze your needs and then reach out with more information about starting a journey toward optimizing your duty drawback.

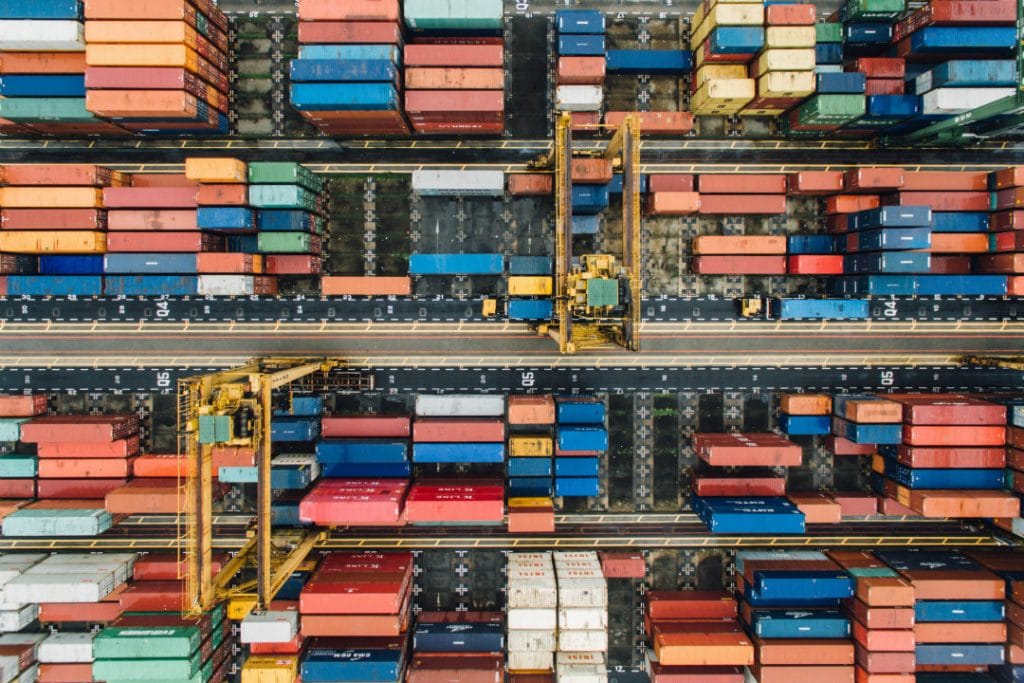

Photo by frank mckenna on Unsplash