If your business imports goods into the United States, you’ve likely heard of duty drawback. However, you may not be aware of the correct type of drawback for your business or how it can help you cut costs.

Duty drawback is a program administered by the U.S. Customs and Border Protection (CBP) agency that allows importers to recover some duties paid on certain goods. Some refunds can represent a significant percentage of the import duties your company paid, making it worthwhile to investigate duty drawback. The place to start is learning about the different duty drawback types and which is right for your business. The two primary types are manufacturing drawback and unused merchandise drawback.

Below, you will find a complete guide to both types of duty drawback, including the factors to consider and tips for maximizing your potential drawback benefits.

Understanding Duty Drawback Types

Each type of duty drawback caters to different business scenarios. Here’s a look at manufacturing and unused merchandise drawback and how your business might benefit from one or the other.

Manufacturing Drawback

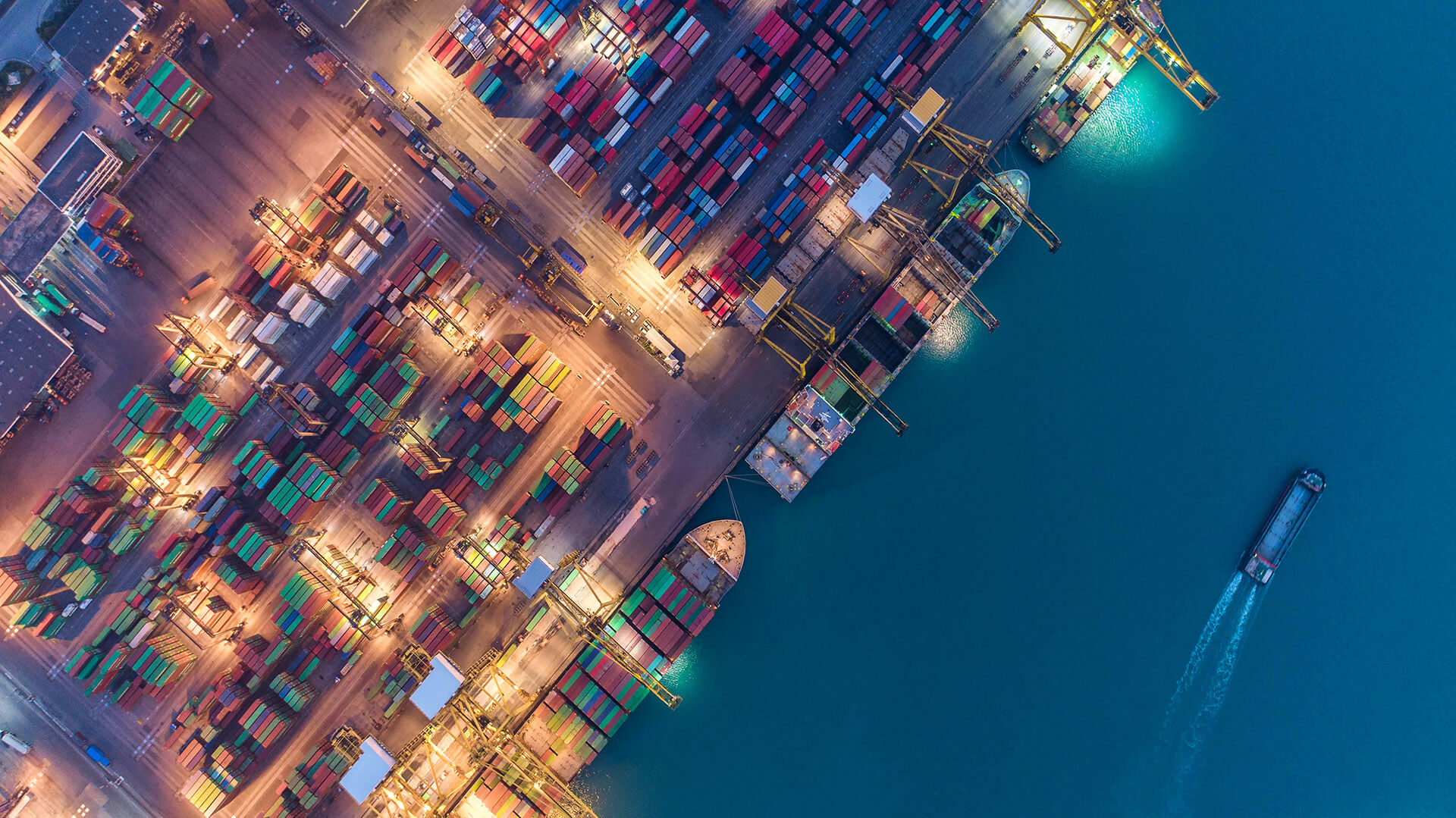

Manufacturing drawback allows businesses to recover some duties and fees paid on imported goods that are subsequently used to manufacture products meant for export. The federal government designed manufacturing drawback to promote domestic manufacturing and drive U.S. exports. To be eligible, the imported goods must be significantly transformed into something new during the manufacturing process.

Benefits of Manufacturing Drawback:

- Cost Reductions: Recovering duty fees lowers manufacturers’ production costs and cost of goods sold.

- Competitive Advantages: Lowered costs mean manufacturers can invest more in their business, making them more competitive in the marketplace.

- Increased Exports: Duty savings encourage manufacturers to create more products for export, stimulating international trade.

Business Scenarios Where Manufacturing Drawback Applies:

- Component Manufacturing: When a company imports raw materials or components to manufacture a finished product meant for export.

- Product Assembly: When businesses import parts intended to assemble a product that’s subsequently exported.

Unused Merchandise Drawback

With unused merchandise drawback, claimants can recover duties, taxes, and fees on imported merchandise that is subsequently exported or destroyed. As the name implies, the merchandise cannot be used in the U.S. before export or destruction. This type of drawback benefits businesses that may overestimate their needs for an imported good or experience a change in demand.

Ways to Identify Unused Goods That Qualify:

- Direct Identification: Requires tracking specific merchandise from import to export or destruction using unique identifiers like serial numbers.

- Substitution: Allows businesses to substitute imported merchandise with others that fall under the same 8-digit HTS numbers.

Business Scenarios Where Unused Merchandise Drawback Applies:

- Overstocked inventory: A business imports more merchandise than needed and decides to export its excess inventory.

- Product returns: Customers return unused merchandise, which the business then exports.

Factors to Consider in Selecting the Right Duty Drawback Type

While the guidelines for each drawback type are relatively straightforward, it’s not always clear which type to use when filing a claim. Given the time, effort, and personnel required, it’s best to ensure your business can realize cost savings before submitting claims to CBP.

Key Considerations:

- Manufacturing Complexity: If imported goods aren’t significantly transformed during manufacturing, they may not be eligible.

- Inventory Management: Excess inventory isn’t always eligible for unused merchandise drawback. Inadequate tracking systems can make claims ineligible.

- Cost Analysis: If duties represent a significant portion of production costs, pursuing a manufacturing drawback claim could be worthwhile. Conversely, if duties are minimal, the claim process may outweigh potential savings.

- Processing Costs: Filing claims requires investments in software and systems, which should be factored into the cost-benefit analysis.

- Timely Filing: Delays can affect refund timelines, which sometimes take months or years.

Professional Duty Drawback Services

Complex regulations, technology investments, and cost-benefit analyses can make duty drawback claims challenging. Fortunately, you can leave it to the professionals. J.M. Rodgers has over 70 years of experience with freight import, export, customs brokerage, and professional duty drawback services.

Our in-house proprietary duty drawback software ensures we file the right claim for the maximum potential refund on behalf of your business. We have the technology, staff, and expertise to file claims efficiently, leading to millions of dollars in potential refunds across industries.

Schedule a Free Duty Drawback Consultation Today!

Frequently Asked Questions (FAQs)

1. What is duty drawback?

Duty drawback is a U.S. Customs program that allows businesses to recover certain duties, taxes, and fees paid on imported goods that are later exported or destroyed.

2. How do I know which duty drawback type is right for my business?

It depends on whether your imported goods are used in manufacturing or remain unused before export. Consulting with professionals like J.M. Rodgers can help determine the best fit.

3. How long does it take to receive a duty drawback refund?

Processing times can vary, sometimes taking several months or even years, depending on claim complexity and CBP processing times.

Image Credit: rawpixel.com/Freepik