Rate & Market Information

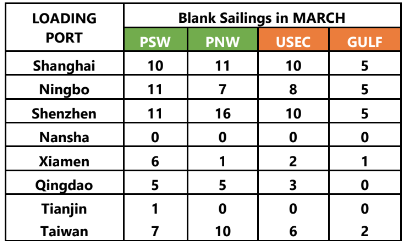

Transpacific market remains quite in Feb and March. Spot rates to both coasts continue to drop below pre-pandemic level. Carriers’ blank sailings continue causing service disruption, booking uncertainties and delays in departure dates.

As Carriers continue to blank sailings and omit services, we have experienced more roll overs of containers so we do recommend shippers and importers to plan ahead for time sensitive cargoes.

Please refer to this document for more details

Sign up to Receive JMR’s Freight Market Updates Delivered Directly to Your Inbox

No Fields Found.Service Updates

MATSON HAIPHONG – LONG BEACH EXPRESS (CLX/CLX+)

Matson has upgraded Haiphong – Long Beach Express Service to 17 days, effective from the 1st sailing on ETD Haiphong March 9. CLX service (Matson Independent Terminal – Pier C60)

China Postal Codes – New US CBP Requirement

From March 18, 2023, CBP will deploy a new requirement for all U.S. importers under the Uyghur Forced Labor Prevention Act (UFLPA). The goods produced in the Xinjiang Uyghur Autonomous Region would be subject to UFLPA restrictions and may be prohibited from entry into the United States.

A 6-digit valid China postal code must be transmitted in Customs entry data for all Manufacturer Identification Codes (MIDs) when China is the manufacturer’s country of origin. CBP will begin to use the postal code to determine whether goods might be detained upon arrival under UFLPA. If the postal code transmitted is located in Xinjiang province, the goods will be detained. If an invalid postal code is transmitted, or the postal code is missing, the goods will not be released until a valid code is provided to CBP.

It’s critical that the China postal code is accurate to avoid costly delays and potential detention of merchandise by CBP. Here a few points you must pay attention.

1. All suppliers are required to provide the China postal code at the time of booking.

2. Check the China postal code to ensure the goods are not produced in Xinjiang province. 3. Check the China postal code to ensure that it is a valid postal code.

4. If the postal code is located in Xinjiang province or invalid, notify the Consignee before accepting the booking, meanwhile working with the supplier to resolve the issue.

5. It would be fine to share the China postal code listed on commercial documents, or in booking/pre-alert with client’s Customs broker for entry purposes.

Market News

Imports sink again as wholesale inventories remain bloated

National Retail Federation: ‘Modest’ import rebound to start this month

Source: Greg Miller

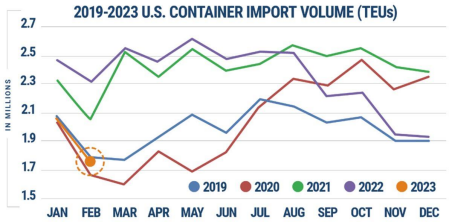

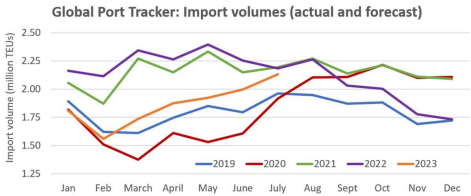

February is typically a bad month for U.S. imports. This February was particularly rough, as the effect of the early Lunar New Year holiday collided with a giant U.S. inventory overhang.

Signals are mixed on where imports go from here.

The National Retail Federation (NRF) believes a moderate rebound in imports is around the corner. But new Census Bureau data on January wholesale inventory-to-sales ratios implies more trouble ahead.

In line with pre-COVID volumes

On Tuesday, Descartes reported that February imports to all U.S. ports totaled 1,734,272 twenty-foot equivalent units. That’s down 16.2% from January, 25% year on year and 0.3% versus February 2019, pre-COVID.

Imports from China were particularly weak, given COVID issues and the Lunar New Year break. Imports from China fell 118,442 TEUs or 32% in February versus January, said Descartes.

U.S. ports have not released their own February numbers yet, but Descartes’ port-level data showed double-digit declines versus January.

Volumes through January 2023 are actual; February-July 2023 projected. (Chart: American Shipper based on data from Global Port Tracker).

“There are many uncertainties about the economy, but we expect imports to show modest gains over the next few months,” said Jonathan Gold, the NRF’s vice president of supply chain and customs policies.

Wholesale inventory headwinds

During the recent quarterly calls of ocean carriers Hapag-Lloyd and Maersk, executives blamed weak import demand on destocking. Until excess inventories piled up in 2022 are sold off, they said, import demand will lag consumer demand. If consumption continues at current levels, they expect the inventory overhang to be whittled down and import demand to ramp back up at some point this year, with the second half stronger than the first.

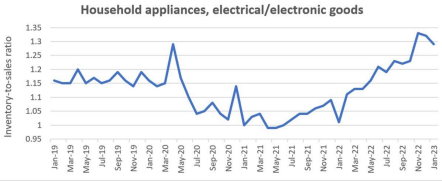

Census Bureau data released Tuesday on January wholesale inventory-to-sales ratios implies destocking has a long way to go. Ratios remain high, with very limited progress in January.

Looking at some of the more heavily containerized categories, the seasonally adjusted wholesale inventory-to-sales ratio for household appliances and electric and electronic goods was 1.29 in January, still up 11% from January 2019, pre COVID.

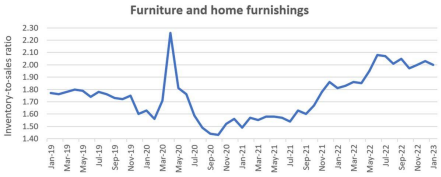

Seasonally adjusted. (All inventory-to-sales charts by FreightWaves based on data from U.S. Census Bureau/FRED) Wholesale inventory was double sales for furniture and home furnishing this January and up 13% from January 2019.

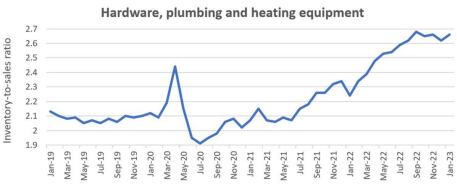

The wholesale inventory situation was even worse in the hardware, plumbing and heating equipment category.

The inventory-to-sales ratio was 2.66 in January, higher than in December and not far below the peak of 2.68 in September. This January’s ratio was 25% higher than in January 2019.

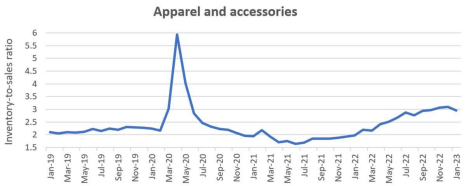

And for apparel — a major containerized cargo type — the wholesale inventory situation is particularly challenging. The seasonally adjusted inventory-to-sales ratio in January was 2.95.

Excluding the spike in 2020 during COVID lockdowns (when sales crashed, temporarily inflating the ratio), the January number was close to the recent high of 3.1 the month before. This January’s inventory-to-sales ratio was a whopping 40% above the January 2019 pre-COVID figure.

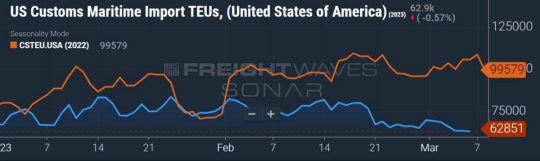

A sign of continued import weakness: U.S. Customs import data through Tuesday shows ongoing TEU volume declines in March and a widening year-on-year gap. (Chart: FreightWaves SONAR).

Container shipping market yet to bottom as spot rates keep slipping

Pace of rate decline has slowed, but market continues to deteriorate

Source: Greg Miller

Xeneta CEO Patrik Berglund said in late November that if spot rates had not stabilized and started to rise again by the first and second quarters of this year, “carriers have played this market really badly.”

By that definition, ocean carriers have played this market really badly.

Spot indexes are not plummeting like they were in the second half of 2022, but they’re still inching downward week after week. The market bottom is proving elusive as transport capacity continues to exceed demand.

The spot market is signaling where annual contract rates are heading in 2023.

Contract revenues are more important to carriers’ bottom lines than spot revenues and carriers are entering this year’s trans-Pacific contract negotiation season with an extremely weak hand amid a backdrop of still-falling spot rates.

Freightos Baltic Daily Index

Different spot indexes post different rate assessments, but the directional trends are generally the same.

The Freightos Baltic Daily Index (FBX) assessed spot rates in the China-West Coast lane at $1,040 per forty-foot equivalent unit on Friday, down 94% year on year (y/y) and down 30% versus March 2019, pre-COVID.

FBX put Friday’s China-East Coast rate at $2,286 per FEU (minus-87% y/y, minus-17% versus pre-COVID).

Meanwhile, the trans-Atlantic market continues to far outperform the trans-Pacific. FBX’s westbound Europe-East Coast assessment was at $4,418 per FEU on Friday, down only 36% y/y and up 89% versus March 2019.

The year-to-date (YTD) changes show the pace of rate declines in the trans-Pacific has decelerated versus last year, but rates are still headed lower.

The FBX China-West Coast index rate is down 25% YTD, China-East Coast 21% and Europe-East Coast 20%.

Blue line: China-West Coast. Orange line: China-East Coast. Green line: Europe-East Coast. (Chart: FreightWaves SONAR)

Drewry World Container Index

The Drewry World Container Index (WCI) assessed Shanghai-Los Angeles spot rates for the week ending Thursday at $1,948 per FEU.

That’s down 2% YTD, 82% y/y and — in contrast to what the FBX says — up 23% since March 2019, pre-pandemic.

Blue line: Shanghai-Los Angeles. Orange line: Shanghai-New York. Green line: Rotterdam-New York. (Chart: FreightWaves SONAR)

The WCI assessed Shanghai-New York spot rates at $2,772 per FEU, down 29% YTD, 79% y/y and 1% versus March 2019.

In the still-strong Rotterdam, Netherlands-to-New York market, the WCI assessed spot rates at $5,573 per FEU, down 20% YTD and 14% y/y, but up 179% versus March 2019.

Drewry said it expects “small week-on-week reductions in rates in the next few weeks.”

Other indexes

Other data sources tell the same story: The ocean container freight market, while more stable than in the second half of 2022, has yet to truly find a floor.

The Shanghai Containerized Freight Index, which gauges spot levels on all mainline routes from that Chinese port, fell to 931 points in the week ending Friday. That’s down 12% YTD and 66% y/y but still up 16% from March 2019.

Xeneta’s short-term index, the XSI-C, was at $1,259 per FEU for the Far East-U.S. West Coast lane as of Wednesday, down 4% week on week and 10% month on month.

The Platts index for North Asia-North America was unchanged in the week ending Friday. Sources told Platts “volumes are too weak to make a dent in rates” and “margins are terrible.” The weak spot market has convinced “many shippers to delay contract negotiations,” Platts reported.

Still too much capacity

Lower rates and weaker vessel utilization confirm there is too much capacity in relation to cargo demand.

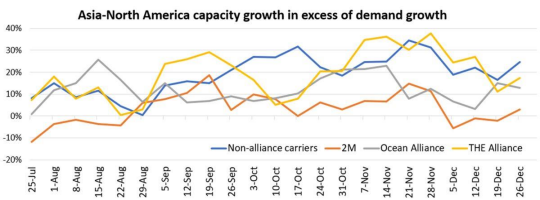

Sea-Intelligence analyzed the extent of the imbalance in the Asia-North America trade lane. In a report published Sunday, it measured the percentage difference between capacity growth and demand growth throughout the second half of 2022, a period when spot rates fell sharply.

Sea-Intelligence looked at the balance for each of the three big alliances — 2M, Ocean Alliance and THE Alliance — as well as for non-alliance carriers.

Four-week trailing averages. Non-alliance services of carrier members of alliances are included in alliance figures. (Chart: Sea-Intelligence Sunday Spotlight No. 603)

It found that members of THE Alliance (Cosco, CMA CGM, Evergreen), non-alliance carriers and 2M member Maersk “contributed the most to structural capacity in the trans-Pacific trade.”

“These carriers are more responsible for overcapacity in the market than the other carriers,” said Sea-Intelligence CEO Alan Murphy.

Looking at the average of all carriers, excess capacity topped demand by the highest degree in November — at over 20% more than demand — and the gap was still in the low to midteens in December.

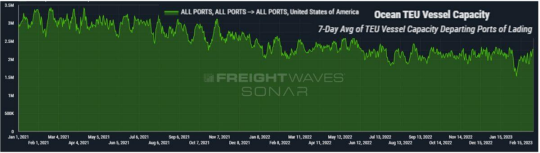

Another indicator of excess capacity: FreightWaves SONAR’s Container Atlas tracks the seven-day trailing average of container-ship capacity bound for the U.S., based on departure dates.

This data shows inbound capacity to the U.S. is down by around a third from peak levels in 2021. However, despite falling spot rates, Container Atlas data shows no significant decrease in inbound capacity over the past five months, excluding the temporary dip for Lunar New Year.

(Chart: FreightWaves SONAR Container Atlas)

Shipping lines have 'lost control of the market': Drewry

OCEAN carrier voyage results could soon start appearing in red ink as freight rates flirt with breakeven levels on major east-west tradelanes.

Although the container spot rate crash appears to have bottomed-out in the past few weeks, annual contract rates are also now in sharp decline.

According to Drewry’s latest Container Insight report, carriers have “lost control of the container market” by failing to manage capacity and will “act on capacity only when they are forced to do so by heavy losses”,

reports London’s Loadstar.

Rising Covid cases in China cripple major factories and biggest ports

Logistics managers are warning clients that because of the spike in infections, factories are unable to complete orders – even with US manufacturing orders from China already down 40 per cent due to an unrelenting demand collapse.

The above information is for reference only. However, should you have any inquiries, please do not hesitate to contact us.

For rate inquiries: jmr-rates@jmrodgers.com | For export operations & inquiries: jmr-export@jmrodgers.com | For ISF submission and status inquiries: jmr-isf@jmrodgers.com | For import operations & inquiries: jmr-docs@jmrodgers.com | For traffic-related issues: traffic@jmrodgers.com

Disclaimer

Although J.M. Rodgers Co., Inc. (JMR) makes reasonable efforts to obtain reliable content, JMR does not guarantee the accuracy of or endorses the views and opinions given by any third-party content provider. JMR disclaims all responsibility for any mistakes or inaccuracies in the information. Further, JMR disclaims all liability for loss or damage resulting from the use of information in this newsletter.

![[January Market Report] Transpacific Rates and Space Situation Updates](https://www.jmrodgers.com/wp-content/uploads/2021/07/port-of-long-beach.jpg)

![[July Market Report] Transpacific Rates and Space Situation Updates](https://www.jmrodgers.com/wp-content/uploads/2022/07/july-market-update.jpg)

![[June Market Report] Transpacific Rates and Space Situation Updates](https://www.jmrodgers.com/wp-content/uploads/2022/06/june-market-update.jpg)

![[May Mid-Month Market Report] Transpacific Rates and Space Situation Updates](https://www.jmrodgers.com/wp-content/uploads/2022/05/jmr-mid-month-market-report-may-2022.jpg)